There is never a bad time to review your existing pension plan. Far too many Britons find themselves in underperforming pension pots while overpaying on fees.

In this blog, we’ll help you decide if you’re getting your money’s worth with your current provider and find out if low-cost investing with InvestEngine’s platform fee-free SIPP is for you.

Capital at risk

In our recent research, we have found that nearly three million workers are at risk of losing out by putting more of their earnings into their workplace pensions. You’re receiving no additional employer contributions, but still paying high fees that are eroding the values of your retirement funds.

How a SIPP can help

But what is a SIPP? A self-invested personal pension (SIPP) allows you to put away more money for your retirement in a tax efficient way.

With more flexibility, you can choose how your money is invested based on what’s important to you. What’s more, your contributions to a SIPP are eligible for tax relief of at least 20%.

Why do costs matter? Many platforms charge fees such as expense ratios, account management fees, trading fees, performance fees and other hidden costs – meaning you’ll see less returns than you had expected to. To put it simply, the lower the costs the more money stays in your pension pot.

InvestEngine charges no fees on the money you have invested into your SIPP, helping you keep more money for your retirement and greater control over what you invest in.

Use our handy calculator to see how choosing low cost investing would make a big difference over time.

The impact of fees

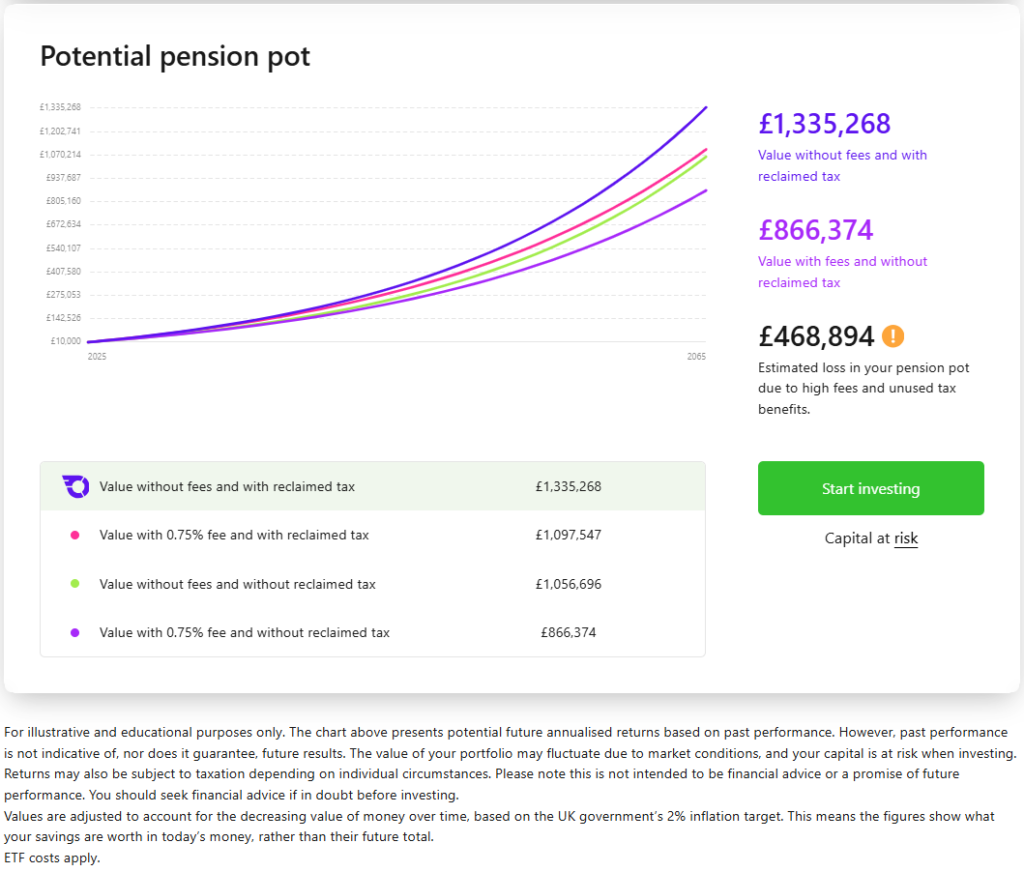

For example, imagine you’re earning £70,000 and you’re saving £400 per month into your workplace pension scheme. You’ve started with a £10,000 lump sum and you’re paying a 0.75% annual fee, with an annual return of 8%.

Over 40 years, you would pay over £237,000 in fees. With an InvestEngine SIPP, that £237,000 would remain yours.

If you failed to reclaim your tax relief, the amount you’d miss out on could reach well over £450,000 as shown in the chart below.

The types of fees that affect pensions

There are a few different fee types that people typically pay on their pensions. Here, we’ll explain what they are and why investors need to be aware of them.

Platform fees

One of the most common fees people pay on their pensions is platform fees. Put simply, these are fees charged by providers for using their service. Typically, these range from around 0.15% to 0.5%, though some can be as high at 0.75%.

Over time, these fees can be significant. Imagine three investors. Investor A pays no platform fees at all, Investor B pays 0.5% while Investor C pays 0.75%. Each of them put in £200 a month for 30 years and achieves an annual growth rate of 5%.

Here’s what each of them ends up with at the end of that 30 year period:

- Person 1 (0% annual fees): £163,075

- Person 2 (0.5% annual fees): £148,765

- Person 3 (0.75% annual fees): £142,156

These figures are purely illustrative and returns will vary, but under these specific conditions, the difference is over £20,000 to the final pension pot.

InvestEngine doesn’t charge platform fees on SIPPs.

Trading fees

Another common fee investors pay is trading fees. These are costs associated with buying or selling assets. These fees can vary significantly depending on the platform you’re using, but they can add up over the years.

Of course, pension investing is (for most people) a long-term project, so you’re unlikely to want to be making regular changes to your portfolio. Having said that, it’s important for investors to be aware if they are paying a fee any time they do make tweaks.

InvestEngine doesn’t charge trading fees on any of its account types.

ETF / Fund fees

ETF fees (or fund fees) are the underlying fees you pay to hold different ETFs in your portfolio. They are typically low and vary quite a bit, ranging from as low as 0.03% to over 0.75% depending on the fund.

So, if you held £1,000 in an ETF in your portfolio with a fee of 0.4% – with a growth rate of 5% per year – for 10 years, you’d pay just over £60 for that fund over the decade.

ETF fees do apply to InvestEngine accounts, but the platform charges no dealing fees and doesn’t make a penny from these ETF costs.

So, what can investors do?

Investing is a long-term project, particularly when it comes to putting money away for retirement. However, it’s always worth checking in to see if you’re paying over the odds on fees for your pension pot.

If you’re paying more than you need to be, you might want to consider switching to an InvestEngine fee-free SIPP. Of course, everyone’s circumstances are different and, if in doubt, you may wish to consult a professional adviser for guidance.

Low fees don’t just save you money – they help to grow your future.

Important information

Capital at risk. The value of your portfolio with InvestEngine can go down as well as up and you may get back less than you invest. ETF costs also apply.

This communication is provided for general information only and should not be construed as advice. If in doubt you may wish to consult a professional adviser for guidance.

Tax treatment depends on personal circumstances and is subject to change, and past performance is not a reliable indicator of future returns.